Graduate School of Science and Engineering Science of Environment and Mathematical Modeling

- Course Outline

- Earth and Space Materials Science

- Geo-environmental Science Laboratory

- Wild Life Preservation Laboratory

- Environmental and Sanitary Engineering

- New Energy System Laboratory

- Environmental Systems Engineering Laboratory

- Regional Environment Laboratory

- Geometry Laboratory

- Probability Theory Laboratory

- Statistical Finance Laboratory

- Computational Mathematics Laboratory

- Laboratory of Mathematics for Information

- Discrete Mathematics Laboratory

- Algebraic Geometry

- Analysis Laboratory

Statistical Finance Laboratory

Staff

TSUDA Hiroshi

[Professor]

| Acceptable course | |

|---|---|

| Master's degree course | ✓ |

| Doctoral degree course | ✓ |

Telephone : +81-774-65-7443

Office : HS-206

Database of Researchers

Research Contents

In this uncertain business environment with issues such as global warming, companies have recently become aware of the importance of risk management in various aspects of business management, such as business investment, fund management, and business operations. Risk management requires objective and scientific assessment of various risks, which inevitably uses probability models and statistical methods. The probability models and statistical methods are now also being used for investment decision-making and marketing analysis. The Statistical Finance Laboratory studies statistical and mathematical finance. Areas of research include scientific risk management and risk assessment, asset management approaches, and price fluctuation models in financial and stock markets.

(1) Research on Scientific Risk Management

Our main themes include corporate bankruptcy prediction and credit risk assessment.

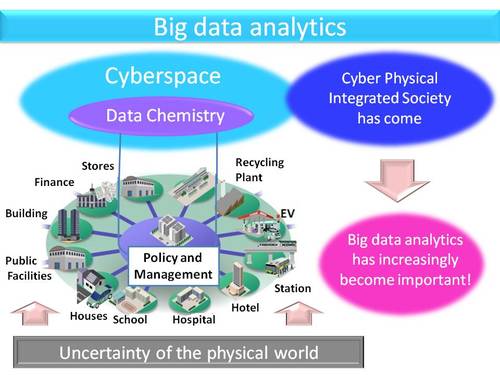

(2) Big Data Analytics

We analyze Big Data using web data and other data sources, mainly targeting tourism, finance, and business management.

Enterprise Value Assessment and Intangibles

Entering the 21st century, companies have shifted their main constituents of enterprise value and growth from tangible assets to intangibles, or particularly to intangible assets including technological capabilities and brand power. The government as well as companies are now seeking for improved capabilities of value creation and business management focusing on intangibles. Intangibles, or specifically technological capabilities, brand power, organizational capital, and human capital, produce future cash flows (claim rights) with no physical form or with no form as financial products. Business management requires a strategic perspective for intangibles, including innovation capital such as intellectual property (IP), relational capital such as brands, human capital, and organizational capital. We use corporate finance theory and statistical science to evaluate technological capabilities, brand power, and organizational capital of companies.

Keywords

- Financial Engineering

- Statistical Sciences

- Risk Assessment

- Tourism Science

- Business Management Analyses